DPG Policy Briefs

FDI Flows to India: Recent Trends, Challenges and Way Forward

Authors:

Dr. Durgesh K. Rai

Date: February 28, 2021

The role of foreign direct investment (FDI) in economic growth is multidimensional and well-recognised in both developed and developing countries. FDI also plays a vital role in facilitating the integration of global value chains across countries. However, the flow of FDI is not automatic: it is subject to many factors including regulatory policy, investment environment, competitiveness, market size and political stability in the host country. The shift in the centre of gravity of the world economy and a very aggressive policy stance to encourage FDI by key countries in the Asian region have resulted in diverting the flow of FDI towards Asia, especially to major economies like China and India. In 2020, as most Western economies have struggled to cope with the COVID-19 pandemic, the shift in global FDI flows towards Asia has been amplified further.

According to the ‘Investment Trend Monitor’, issued by the United Nations Conference on Trade and Development (UNCTAD) in January 2021, global FDI has seen a sharp decline in 2020 because of the COVID-19 pandemic. In 2020, global FDI collapsed by more than 42 per cent, declining from about US$1.5 trillion in 2019 to an estimated US$859 billion in 2020. India and China were the only major FDI destination economies that bucked the trend and attracted positive growth in FDI flows over the previous year. While FDI flows to India increased by 13% to an estimated US$57 billion, there was a 4% increase in FDI to China to an estimated US$163 billion. However, there has been a sharp decline in FDI inflows to most other major economies, including the US, Germany, France, the UK and Brazil.

The US has been the top recipient of FDI flows in the world for decades, but a sharp decline of over 49% in 2020 has pushed the country to the second spot while China, which has ranked second for long, has replaced the US as the world’s top destination for FDI flows in 2020. Although the gap between the US and China in terms of FDI inflow has been declining for the last five years, the fall of the US from the top spot in 2020 is mainly due to its management of the COVID-19 pandemic. However, the US is likely to regain its position once the pandemic is controlled and pre-pandemic economic growth is restored, at least for the next few years. As per the IMF’s World Economic Outlook Update, January 2021, the US economy is projected to grow at 5.1% in 2021 and 2.5% in 2022.

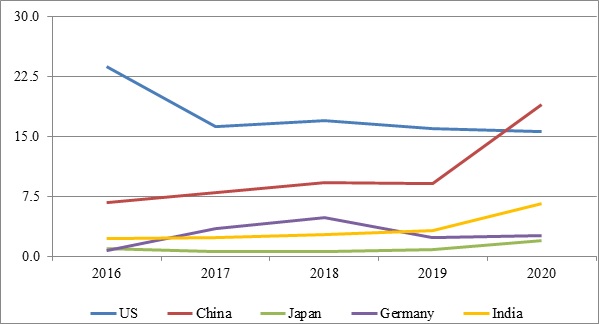

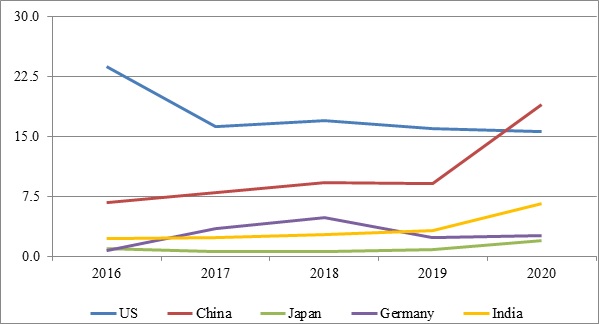

Figure 1 shows the changing shares of five major economies in global FDI flows over the last five years. While the share of the US in global FDI flows has declined steadily from 24% in 2016 to 16% in 2020, the shares of India and China have increased from 2.2% and 6.7% to 6.6% and 19% respectively during the same period. It is important to note, however, that the gap between India and China remains significantly high. Japan has seen a steady rise in its FDI share since 2017, while FDI flows to Germany have fluctuated. While FDI flows to Japan have always been lower than to India during the last five years, Germany has also witnessed lower FDI flows than India in the last two years.

Figure 1: Share (%) of India and other major economies in global FDI flows

Source: World Investment Report 2020 and UNCTAD’s Investment Trend Monitor, January 2021

Note: Data on FDI flows for 2020 are estimated

According to the ‘Fact Sheet on FDI’ by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, there has been substantial growth in FDI inflows into the country during the last five years as compared to that in the preceding five years. The cumulative amount of FDI received by India during 2015-2016 to 2019-20 was around US$312 billion, which was about 59% more than the total FDI of about US$197 billion received during 2010-11 to 2014-15. Figure 2 shows FDI inflows into India since 2010-11. While annual FDI inflows were substantially below US$50 billion before 2015-16, these have remained consistently above US$55 billion subsequently, indicating a substantial upward shift in the level of FDI flows to the country in the last five years. In 2019-20, the total inflow of FDI to India exceeded US$74 billion; this is likely to increase further in 2020-21 as data available for the first six months (April to September 2020) shows an FDI inflow of about US$40 billion, which is the highest ever for a comparable period in any year. The latest surge is largely attributable to the computer software and hardware sector,that alone has attracted FDI equity inflows of US$17.55 billion in the first half of 2020-21. Another positive aspect that needs to be highlighted is that the FDI flow to India has largely been dominated by equity, which constituted about 70% of total FDI received by India in 2019-20.

Figure 2: FDI flows to India, in US$ million

.png)

Source: DPIIT, Ministry of Commerce and Industry

Note: FDI figures for 2018-19 and 2019-20 are provisional

As far as the sectoral composition of FDI inflows is concerned, non-manufacturing sectors continue to be the most important FDI recipients in India. As Table 1 demonstrates, services including finance, banking, insurance, outsourcing, R&D, courier, etc., constituted more than 17% of the cumulative FDI equity received by the country until March 2020.[1] This was followed by computer software and hardware (software is the main constituent), telecommunications, trading and construction development that include townships, housing etc. These top five, mainly non-manufacturing sectors, attracted more than 46% of the country's total cumulative FDI equity until March 2020. The only manufacturing industries that were ranked among the top 10 FDI receiving sectors were automobiles, chemicals, and drug and pharmaceuticals. Other manufacturing sectors that have appeared in the top 20 recipient sectors include the metallurgical, food processing, electrical equipment and industrial machinery industries.

In terms of growth during the last five years, total cumulative FDI equity inflows have increased at a CAGR of 13.6%, increasing from US$248.6 billion in March 2015 to more than US$470 billion in March 2020. FDI equity inflow to infrastructure construction has seen the maximum growth at a CAGR of 37.4%, rising from US$3.4 billion to US$16.8 billion during the same period. This was followed by trading (27.9%), computer software and hardware (24.5%), non-conventional energy (20.6%), information and broadcasting (18.3%), hospitals and diagnostic centres (18%), electrical equipment (17.3%), telecommunications (16.9%) and consultancy services (15.4%). Other major sectors that attracted FDI inflows at growth rates higher than total FDI equity include automobiles (14.4%), hotels and tourism (14.1%) and services (13.9%). As in the case of the quantity of FDI flows, in terms of growth in the last five years too, it is again non-manufacturing industries that have dominated FDI inflows. Despite a significant step up in overall FDI inflows in the recent past, flows into manufacturing are still below the desired level, notwithstanding the considerable policy focus on enhancing the capacity and competitiveness of Indian manufacturing. Automobiles and electrical equipment are the only manufacturing industries that have attracted FDI inflows at a rate higher than that for total FDI inflows.

Table 1: Composition of Cumulative FDI Equity in India (April 2000 to March 2020)

Source: FDI Fact Sheet, DPIIT, Ministry of Commerce and Industry

The recent spurt in FDI inflows into India can be attributed to various factors, including several bold policy reforms and initiatives undertaken by the government over the last few years to enhance economic competitiveness and the ease of doing business in the country. Besides, political stability has also boosted the confidence of foreign investors. The most important policy reforms that had been pending for long but that were implemented by the government only in the recent past include the introduction of the goods and services tax (GST) regime and a significant cut in the corporate profit tax rate to 17% for new manufacturing firms and 25% for other firms. The reduction in the corporate tax rate has made India more attractive from a tax perspective and put the country on par with many counterparts in the Asian region. Other major reforms that have contributed to improving the overall investment environment in the country include the progressive liberalisation of the FDI regime relating to key sectors like manufacturing, railways, insurance, pension, defence, construction, single brand retail trading, coal mining, etc. The rationalisation of labour laws into four labour codes and the implementation of the Insolvency and Bankruptcy Code, 2016, have also helped enhance India’s attractiveness.

Attracting foreign investment has been a key focus area under the earlier ‘Make in India’ programme and now the recently launched ‘Aatmanirbhar Bharat Abhiyan’ campaign. The government has made targeted efforts to introduce reforms in all the areas covered by the World Bank’s ‘Doing Business’ framework, but focus was mainly on parameters like paying taxes, trading across borders, and resolving insolvency. As a result, India has made commendable progress in ease of doing business over the last few years and demonstrated its commitment to reform. The country has improved its overall ranking from 130th in 2016 to 63rd in 2020. However, India still has some significant catching up to do to be on par with Asian counterparts like China (31st), Thailand (21st) etc. The improvement in India’s investment climate has also been reflected in the OECD’s FDI Regulatory Restrictiveness Index, in which India’s FDI restrictiveness had declined from 0.244 in 2015 to 0.207 in 2019. Although India’s position is better than that of China’s 0.244, we fall significantly behind some of our other FDI competitors like Vietnam (0.130).

Recognising the importance of logistics in determining economic competitiveness and attracting FDI, the government has undertaken several initiatives to improve the efficiency of the logistics sector in the country. Apart from focusing on the expansion and up-gradation of hard infrastructures like roads, railways, airports and ports, the government has also undertaken many logistics process-related reforms. Some of the key process reforms include paperless EXIM trade process through E-Sanchit, radio frequency identification (RFID) tagging of all EXIM containers for track and trace, mandatory electronic toll collection system (FASTag). etc., which have significantly helped improve logistics efficiency in the country. According to the World Bank’s ‘Connecting to Compete 2018’ report, with a logistics performance index (LPI) score of 3.18, India was ranked at 44th among 160 economies and was one of the top performers among the lower middle-income countries. Another important factor that could be contributing to a step up in FDI inflows is increasing competition among states to attract investment, with many states offering a variety of incentives to lure investors.

Although recent reform measures and key initiatives undertaken by the government have contributed to a significant spurt in FDI inflows in the recent past, there still exist many areas that need further reforms and action to realise India’s potential. For the last few years, India has seen a continuous hike in tariffs in key sectors like electronics. Although this could help enhance the flow of market seeking FDI in a few sectors, a stable and lower tariff regime is necessary to ensure the competitiveness of the economy, which is critical for sustainable FDI inflows in the medium to long run, especially for efficiency-seeking FDI. Efficiency-seeking FDI is important for sectors that lack scale in the country. High tariffs, especially on intermediate products, could also hamper India’s participation in global production networks. Although the recent changes in tariff rates could be useful as long as coverage remains aligned with the production linked incentive (PLI) scheme, it is important to have a stable and lower tariff regime that is comparable with those of competitor economies to ensure robust and broad based FDI inflows in the long run.

While there has been a significant improvement in access to electricity, high commercial and industrial (C&I) power tariff and quality of supply remain major areas of concern for industry. In this regard, some measures were announced as part of COVID-19 package in 2020, but their implementation at the state level is the key and requires state-specific focus from the centre.

India has made significant improvements on some parameters of ‘ease of doing business’ over the last few years, but still has a long way to go in other key areas like enforcing contracts, registering property, starting a business and paying taxes, where India has been ranked very poorly compared to many of its competitor economies. To improve these parameters, the government has to undertake reforms in areas like judicial processes through digitisation and a paperless court system, rapid digitisation of land records, further simplification of GST, and establishment of a one-stop shop for central and state government clearances/approvals. Logistics is still a significant hindrance deterring FDI flows, particularly of efficiency-seeking FDI. Along with ensuring timely completion of key infrastructure projects like the dedicated freight corridors, the government needs to focus on structural issues like lack of consistent policies and regulations, the multiplicity of line ministries and agencies dealing with the sector, and sub-optimal modal share in freight movement. It is equally important to maintain a stable and consistent policy regime, including on e-commerce, which is crucial to secure long-term investment commitments.

These steps, along with the PLI scheme, are likely to further increase the inflows of FDI in the country and enhance India’s participation in global value chains in the post COVID-19 economic recovery era.

According to the ‘Investment Trend Monitor’, issued by the United Nations Conference on Trade and Development (UNCTAD) in January 2021, global FDI has seen a sharp decline in 2020 because of the COVID-19 pandemic. In 2020, global FDI collapsed by more than 42 per cent, declining from about US$1.5 trillion in 2019 to an estimated US$859 billion in 2020. India and China were the only major FDI destination economies that bucked the trend and attracted positive growth in FDI flows over the previous year. While FDI flows to India increased by 13% to an estimated US$57 billion, there was a 4% increase in FDI to China to an estimated US$163 billion. However, there has been a sharp decline in FDI inflows to most other major economies, including the US, Germany, France, the UK and Brazil.

The US has been the top recipient of FDI flows in the world for decades, but a sharp decline of over 49% in 2020 has pushed the country to the second spot while China, which has ranked second for long, has replaced the US as the world’s top destination for FDI flows in 2020. Although the gap between the US and China in terms of FDI inflow has been declining for the last five years, the fall of the US from the top spot in 2020 is mainly due to its management of the COVID-19 pandemic. However, the US is likely to regain its position once the pandemic is controlled and pre-pandemic economic growth is restored, at least for the next few years. As per the IMF’s World Economic Outlook Update, January 2021, the US economy is projected to grow at 5.1% in 2021 and 2.5% in 2022.

Figure 1 shows the changing shares of five major economies in global FDI flows over the last five years. While the share of the US in global FDI flows has declined steadily from 24% in 2016 to 16% in 2020, the shares of India and China have increased from 2.2% and 6.7% to 6.6% and 19% respectively during the same period. It is important to note, however, that the gap between India and China remains significantly high. Japan has seen a steady rise in its FDI share since 2017, while FDI flows to Germany have fluctuated. While FDI flows to Japan have always been lower than to India during the last five years, Germany has also witnessed lower FDI flows than India in the last two years.

Figure 1: Share (%) of India and other major economies in global FDI flows

Source: World Investment Report 2020 and UNCTAD’s Investment Trend Monitor, January 2021

Note: Data on FDI flows for 2020 are estimated

According to the ‘Fact Sheet on FDI’ by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, there has been substantial growth in FDI inflows into the country during the last five years as compared to that in the preceding five years. The cumulative amount of FDI received by India during 2015-2016 to 2019-20 was around US$312 billion, which was about 59% more than the total FDI of about US$197 billion received during 2010-11 to 2014-15. Figure 2 shows FDI inflows into India since 2010-11. While annual FDI inflows were substantially below US$50 billion before 2015-16, these have remained consistently above US$55 billion subsequently, indicating a substantial upward shift in the level of FDI flows to the country in the last five years. In 2019-20, the total inflow of FDI to India exceeded US$74 billion; this is likely to increase further in 2020-21 as data available for the first six months (April to September 2020) shows an FDI inflow of about US$40 billion, which is the highest ever for a comparable period in any year. The latest surge is largely attributable to the computer software and hardware sector,that alone has attracted FDI equity inflows of US$17.55 billion in the first half of 2020-21. Another positive aspect that needs to be highlighted is that the FDI flow to India has largely been dominated by equity, which constituted about 70% of total FDI received by India in 2019-20.

Figure 2: FDI flows to India, in US$ million

.png)

Source: DPIIT, Ministry of Commerce and Industry

Note: FDI figures for 2018-19 and 2019-20 are provisional

As far as the sectoral composition of FDI inflows is concerned, non-manufacturing sectors continue to be the most important FDI recipients in India. As Table 1 demonstrates, services including finance, banking, insurance, outsourcing, R&D, courier, etc., constituted more than 17% of the cumulative FDI equity received by the country until March 2020.[1] This was followed by computer software and hardware (software is the main constituent), telecommunications, trading and construction development that include townships, housing etc. These top five, mainly non-manufacturing sectors, attracted more than 46% of the country's total cumulative FDI equity until March 2020. The only manufacturing industries that were ranked among the top 10 FDI receiving sectors were automobiles, chemicals, and drug and pharmaceuticals. Other manufacturing sectors that have appeared in the top 20 recipient sectors include the metallurgical, food processing, electrical equipment and industrial machinery industries.

In terms of growth during the last five years, total cumulative FDI equity inflows have increased at a CAGR of 13.6%, increasing from US$248.6 billion in March 2015 to more than US$470 billion in March 2020. FDI equity inflow to infrastructure construction has seen the maximum growth at a CAGR of 37.4%, rising from US$3.4 billion to US$16.8 billion during the same period. This was followed by trading (27.9%), computer software and hardware (24.5%), non-conventional energy (20.6%), information and broadcasting (18.3%), hospitals and diagnostic centres (18%), electrical equipment (17.3%), telecommunications (16.9%) and consultancy services (15.4%). Other major sectors that attracted FDI inflows at growth rates higher than total FDI equity include automobiles (14.4%), hotels and tourism (14.1%) and services (13.9%). As in the case of the quantity of FDI flows, in terms of growth in the last five years too, it is again non-manufacturing industries that have dominated FDI inflows. Despite a significant step up in overall FDI inflows in the recent past, flows into manufacturing are still below the desired level, notwithstanding the considerable policy focus on enhancing the capacity and competitiveness of Indian manufacturing. Automobiles and electrical equipment are the only manufacturing industries that have attracted FDI inflows at a rate higher than that for total FDI inflows.

Table 1: Composition of Cumulative FDI Equity in India (April 2000 to March 2020)

| Rank | Sector | FDI Equity | Share in total FDI Equity |

|---|---|---|---|

| 1 | Services | 82,002.96 | 17.44 |

| 2 | Computer Software &Hardware | 44,911.21 | 9.55 |

| 3 | Telecommunications | 37,270.95 | 7.93 |

| 4 | Trading | 27,594.95 | 5.87 |

| 5 | Construction Development | 25,662.33 | 5.46 |

| 6 | Automobile Industry | 24,210.68 | 5.15 |

| 7 | Chemicals (excluding fertilizer) | 17,639.48 | 3.75 |

| 8 | Construction (Infrastructure) Activities | 16,846.88 | 3.58 |

| 9 | Drugs & Pharmaceuticals | 16,500.62 | 3.51 |

| 10 | Hotel & Tourism | 15,288.97 | 3.25 |

| 11 | Power | 14,987.93 | 3.19 |

| 12 | Metallurgical Industries | 13,401.78 | 2.85 |

| 13 | Food Processing Industries | 9,980.75 | 2.12 |

| 14 | Non-Conventional Energy | 9,225.51 | 1.96 |

| 15 | Information & Broadcasting | 9,208.14 | 1.96 |

| 16 | Electrical Equipment’s | 8,604.02 | 1.83 |

| 17 | Petroleum & Natural Gas | 7,824.16 | 1.66 |

| 18 | Hospital & Diagnostic Centres | 6,726.93 | 1.43 |

| 19 | Consultancy Services | 5,834.81 | 1.24 |

| 20 | Industrial Machinery | 5,619.50 | 1.20 |

| Above total | 399,342.56 | 84.94 | |

| Total FDI | 470,118.99 | 100.00 |

The recent spurt in FDI inflows into India can be attributed to various factors, including several bold policy reforms and initiatives undertaken by the government over the last few years to enhance economic competitiveness and the ease of doing business in the country. Besides, political stability has also boosted the confidence of foreign investors. The most important policy reforms that had been pending for long but that were implemented by the government only in the recent past include the introduction of the goods and services tax (GST) regime and a significant cut in the corporate profit tax rate to 17% for new manufacturing firms and 25% for other firms. The reduction in the corporate tax rate has made India more attractive from a tax perspective and put the country on par with many counterparts in the Asian region. Other major reforms that have contributed to improving the overall investment environment in the country include the progressive liberalisation of the FDI regime relating to key sectors like manufacturing, railways, insurance, pension, defence, construction, single brand retail trading, coal mining, etc. The rationalisation of labour laws into four labour codes and the implementation of the Insolvency and Bankruptcy Code, 2016, have also helped enhance India’s attractiveness.

Attracting foreign investment has been a key focus area under the earlier ‘Make in India’ programme and now the recently launched ‘Aatmanirbhar Bharat Abhiyan’ campaign. The government has made targeted efforts to introduce reforms in all the areas covered by the World Bank’s ‘Doing Business’ framework, but focus was mainly on parameters like paying taxes, trading across borders, and resolving insolvency. As a result, India has made commendable progress in ease of doing business over the last few years and demonstrated its commitment to reform. The country has improved its overall ranking from 130th in 2016 to 63rd in 2020. However, India still has some significant catching up to do to be on par with Asian counterparts like China (31st), Thailand (21st) etc. The improvement in India’s investment climate has also been reflected in the OECD’s FDI Regulatory Restrictiveness Index, in which India’s FDI restrictiveness had declined from 0.244 in 2015 to 0.207 in 2019. Although India’s position is better than that of China’s 0.244, we fall significantly behind some of our other FDI competitors like Vietnam (0.130).

Recognising the importance of logistics in determining economic competitiveness and attracting FDI, the government has undertaken several initiatives to improve the efficiency of the logistics sector in the country. Apart from focusing on the expansion and up-gradation of hard infrastructures like roads, railways, airports and ports, the government has also undertaken many logistics process-related reforms. Some of the key process reforms include paperless EXIM trade process through E-Sanchit, radio frequency identification (RFID) tagging of all EXIM containers for track and trace, mandatory electronic toll collection system (FASTag). etc., which have significantly helped improve logistics efficiency in the country. According to the World Bank’s ‘Connecting to Compete 2018’ report, with a logistics performance index (LPI) score of 3.18, India was ranked at 44th among 160 economies and was one of the top performers among the lower middle-income countries. Another important factor that could be contributing to a step up in FDI inflows is increasing competition among states to attract investment, with many states offering a variety of incentives to lure investors.

Although recent reform measures and key initiatives undertaken by the government have contributed to a significant spurt in FDI inflows in the recent past, there still exist many areas that need further reforms and action to realise India’s potential. For the last few years, India has seen a continuous hike in tariffs in key sectors like electronics. Although this could help enhance the flow of market seeking FDI in a few sectors, a stable and lower tariff regime is necessary to ensure the competitiveness of the economy, which is critical for sustainable FDI inflows in the medium to long run, especially for efficiency-seeking FDI. Efficiency-seeking FDI is important for sectors that lack scale in the country. High tariffs, especially on intermediate products, could also hamper India’s participation in global production networks. Although the recent changes in tariff rates could be useful as long as coverage remains aligned with the production linked incentive (PLI) scheme, it is important to have a stable and lower tariff regime that is comparable with those of competitor economies to ensure robust and broad based FDI inflows in the long run.

While there has been a significant improvement in access to electricity, high commercial and industrial (C&I) power tariff and quality of supply remain major areas of concern for industry. In this regard, some measures were announced as part of COVID-19 package in 2020, but their implementation at the state level is the key and requires state-specific focus from the centre.

India has made significant improvements on some parameters of ‘ease of doing business’ over the last few years, but still has a long way to go in other key areas like enforcing contracts, registering property, starting a business and paying taxes, where India has been ranked very poorly compared to many of its competitor economies. To improve these parameters, the government has to undertake reforms in areas like judicial processes through digitisation and a paperless court system, rapid digitisation of land records, further simplification of GST, and establishment of a one-stop shop for central and state government clearances/approvals. Logistics is still a significant hindrance deterring FDI flows, particularly of efficiency-seeking FDI. Along with ensuring timely completion of key infrastructure projects like the dedicated freight corridors, the government needs to focus on structural issues like lack of consistent policies and regulations, the multiplicity of line ministries and agencies dealing with the sector, and sub-optimal modal share in freight movement. It is equally important to maintain a stable and consistent policy regime, including on e-commerce, which is crucial to secure long-term investment commitments.

These steps, along with the PLI scheme, are likely to further increase the inflows of FDI in the country and enhance India’s participation in global value chains in the post COVID-19 economic recovery era.

***

[1]DPIIT data on the sectoral composition is available only for the equity component of FDI, which is dominant form of FDI in the country.